SC ST-8F 2010-2025 free printable template

Show details

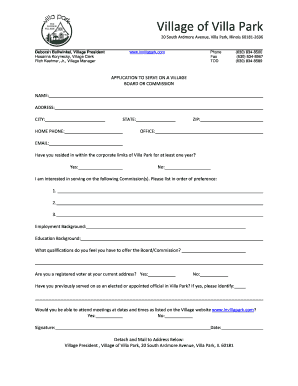

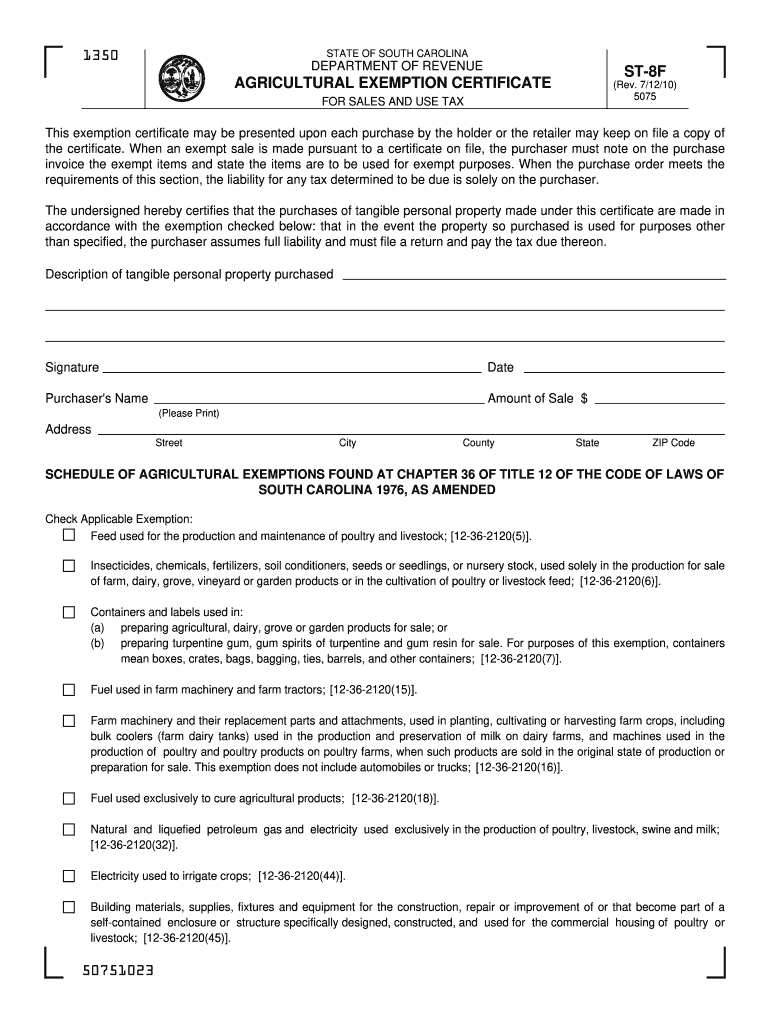

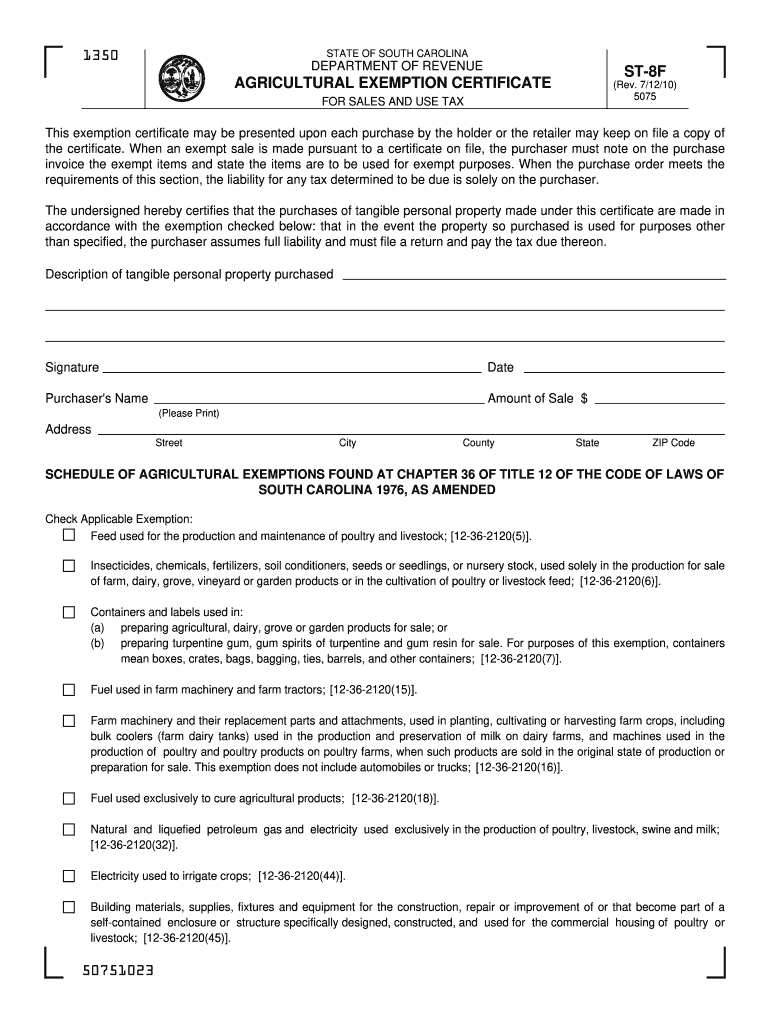

1350 STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE AGRICULTURAL EXEMPTION CERTIFICATE FOR SALES AND USE TAX ST-8F (Rev. 7/12/10) 5075 This exemption certificate may be presented upon each purchase

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign sc agricultural exemption form

Edit your st 8f form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your farm sales tax exemption form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing south carolina agricultural exemption online

To use the services of a skilled PDF editor, follow these steps:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit farming tax exempt form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out south carolina agricultural tax exemption form

How to fill out SC ST-8F

01

Gather all necessary documentation to prove your SC/ST status.

02

Obtain the SC ST-8F form from the appropriate governmental department or website.

03

Fill in your personal details at the top of the form, including your name, address, and contact information.

04

Clearly indicate your caste or tribe as listed in the official government records.

05

Attach relevant documents that support your claim, such as caste certificates or identity proofs.

06

Review the form carefully to ensure all information is accurate and complete.

07

Submit the completed form to the designated authority as instructed.

Who needs SC ST-8F?

01

Individuals belonging to Scheduled Castes (SC) and Scheduled Tribes (ST) who require a certificate for various purposes such as education, employment, or government benefits.

Fill

sc agricultural exemption form

: Try Risk Free

People Also Ask about st8f

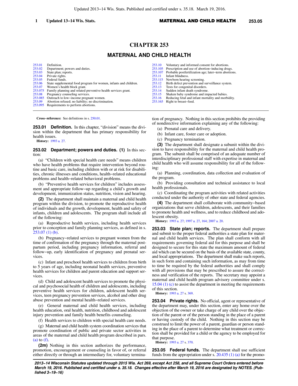

What qualifies as agricultural land in SC?

Definition of Qualifying Agricultural Acreage It includes but is not limited to such real property used for agricultural, grazing, horticulture, forestry, dairying and mariculture. An agricultural use classification is granted to real property which is actually used for agricultural purposes.

How do I get an agricultural tax exemption in South Carolina?

You must provide your South Carolina Agriculture Tax Exemption (SCATE) card to show proof of exemption. The SCATE card can be applied for through the South Carolina Department of Agriculture (SCDA). Submit your application to the SCDA. Retailers cannot accept the ST-8F as proof of exemption.

What is the ST 10 exemption in SC?

The Application for Certificate ST-10 is the document that must be filed in South Carolina in order for a business to claim the Utility Sales Tax Exemption. In South Carolina, a detailed energy study must be performed to identify the exact percentage of utility that is exempt from sales tax.

What is considered agricultural land in South Carolina?

Agricultural Real Property shall mean any tract of real property which is used to raise, harvest or store crops, feed, breed or manage livestock, or to produce plants, trees, fowl or animals useful to man, including the preparation of the products raised thereon for man's use and disposed of by marketing or other means

What qualifies for agricultural exemption in South Carolina?

Farm machinery and their replacement parts and attachments, used in planting, cultivating or harvesting farm crops, including bulk coolers (farm dairy tanks) used in the production and preservation of milk on dairy farms, and machines used in the production of poultry and poultry products on poultry farms, when such

What is the Scate program in South Carolina?

Under the South Carolina Agricultural Tax Exemption (SCATE) program, the South Carolina Department of Agriculture issues cards to individuals eligible to receive agriculture sales tax exemptions under South Carolina state law.

How do I get property tax exemption in South Carolina?

Most property tax exemptions are found in South Carolina Code Section 12-37-220. For any real property exemptions taxation is a year in arrears, meaning to be exempt for the current year, you must be the owner of record and your effective date of disability must be on or before December 31 of the previous year.

How do I get agricultural tax exemption in SC?

You must provide your South Carolina Agriculture Tax Exemption (SCATE) card to show proof of exemption. The SCATE card can be applied for through the South Carolina Department of Agriculture (SCDA). Submit your application to the SCDA. Retailers cannot accept the ST-8F as proof of exemption.

At what age do you stop paying property taxes in South Carolina?

The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally and permanently disabled, or legally blind.

How many acres is agricultural exemption in SC?

The tract is owned in combination with non-timberland tracts that qualify as agricultural real property. Non-timberland (cropland) tracts must be at least 10 acres.

How to apply for property tax exemption in South Carolina?

Where do I apply? You must apply for the Homestead Exemption at your County Auditor's office. If you are unable to go to the Auditor's office, you may authorize someone to apply for you. Contact the County Auditor's Office for details.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send certificate tax sales for eSignature?

south carolina st 8f form is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How can I get retail tax sales?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the south carolina agricultural form in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I edit sc exemption certificate in Chrome?

south carolina agricultural tax exemption can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

What is SC ST-8F?

SC ST-8F is a form used for filing information related to certain transactions under the Service Tax regime in India.

Who is required to file SC ST-8F?

Entities that provide taxable services and are registered under the Service Tax Act are required to file SC ST-8F.

How to fill out SC ST-8F?

To fill out SC ST-8F, one must provide details such as service provider information, service receiver information, type of service, service amount, and any applicable exemptions or deductions.

What is the purpose of SC ST-8F?

The purpose of SC ST-8F is to report the details of services rendered and ensure compliance with service tax regulations.

What information must be reported on SC ST-8F?

Information that must be reported on SC ST-8F includes the name and address of the service provider, service receiver, description of the service, amount charged, applicable service tax, and any relevant exempted amounts.

Fill out your SC ST-8F online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

South Carolina Agricultural Exemption Form is not the form you're looking for?Search for another form here.

Keywords relevant to south carolina st8f

Related to st 8f agricultural exemption certificate

If you believe that this page should be taken down, please follow our DMCA take down process

here

.